Rakiya A. Muhammad

Middle-aged Aliyu Isa in Sokoto, Northwest Nigeria, watched his herd move slowly across the parched landscape, their ribs visible through their thinning hides. In recent months, rainfall had been scarce, transforming the once-lush pastures into barren fields. It’s a scene that has become all too familiar.

“Droughts and unpredictable weather have become a stark reality, affecting water and pasture for livestock,” he says.

Nigeria’s vast herds, which the National Agriculture Sample Survey 2022/2023 put at more than 270 million livestock population in 2023, are the lifeblood for many, fuelling livelihoods through jobs, bustling markets, and essential services.

These animals generate 7 trillion naira for the economy each year, account for about 9% of agricultural GDP, and provide over 30% of the country’s protein, according to the Minister of Livestock Development, Alhaji Idi Mukhtar Maiha.

Growing Shadow Over Production

However, climate change endangers millions of livelihoods. For Isa’s family, the loss of grazing land means hardship and uncertainty.

“Direct impacts of climate on livestock production range from extreme climatic events (such as droughts and floods) to thermal stress and reduced yields or water availability,” highlights the Food and Agriculture Organisation (FAO).

“Climate change also affects the sector indirectly through impacts on forage productivity and quality and on animal diseases, modifying the patterns of affected areas and livestock vulnerability simultaneously.”

The stakes are profound for Isa and his family. Picture their small, modest farmstead at dusk, where the absence of grazing land spells not just a season of hardship but months of uncertainty.

But imagine if there were a way to shield his family and their herd before disaster strikes? What if insurance paid out before the grass disappeared? Such a solution could mean the difference between survival and ruin, offering a lifeline when it is needed most.

This is the promise of the innovative Index-based livestock insurance solution. It provides families such as Isa’s a vital safety net, offering crucial support and resilience before disaster strikes.

Reimagining Insurance for a New Era

In July 2025, the African Reinsurance Corporation (Africa Re), in collaboration with the Livestock Productivity and Resilience Support Project (L-PRES), some insurance companies, and development agencies, launched a pilot initiative for Index-Based Livestock Insurance (IBLI) and Livestock Risk Management in Nigeria.

The tools are designed to help livestock keepers, especially pastoralists with few resources or access to traditional insurance, protect against climate risks. With this insurance, pastoralists get a financial safety net during droughts, allowing them to buy feed, avoid arduous travel, and protect incomes.

With over 20,000 farmers targeted in Bauchi, Adamawa, Plateau, and Sokoto, Isa is optimistic that this insurance will provide essential security and improve their livelihoods.

Temitope Akinowa, Regional Director for West Africa at Africa Reinsurance, underscores the urgent need for innovative responses to climate-driven risks facing livestock farmers in the country.

“The climate crisis is increasingly becoming a driver of avoidable conflicts between herders and crop farmers. While multiple socioeconomic factors are at play, two of the most critical triggers are the rising demand for arable land and the encroachment on traditional grazing routes,” she points out.

“With coordinated action from all stakeholders, we believe this insurance solution can become a powerful tool for reducing climate- driven conflicts and building resilience among both pastoralists and farming communities in northern Nigeria.”

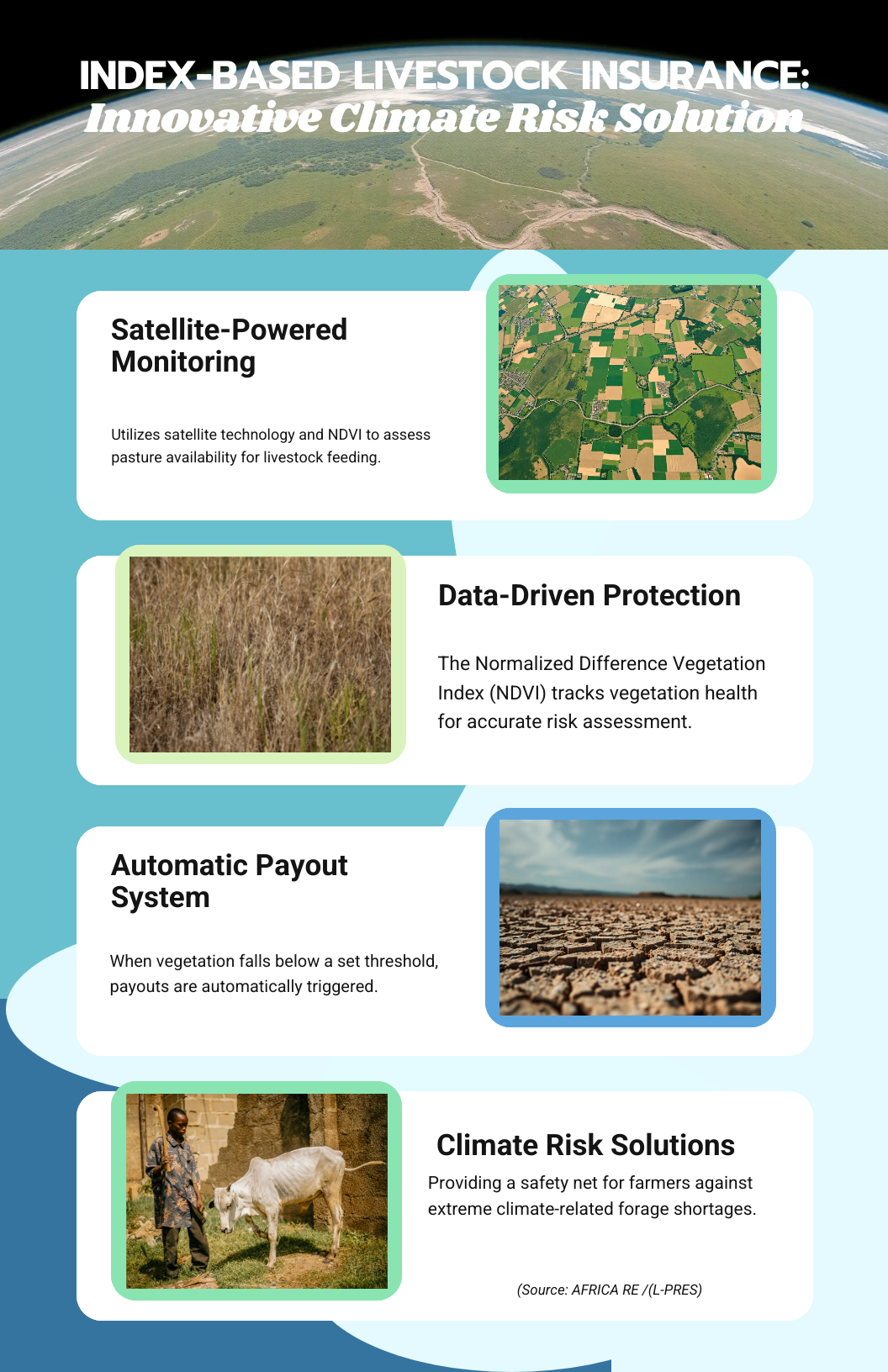

IBLI is powered by satellite technology and utilises the normalized difference vegetation index to assess pasture availability for livestock feeding, as Akinowa elaborates.

“When vegetation levels fall below a predetermined threshold signifying extreme water and forage shortages, automatic payout is triggered.”

Isaac Magina, Manager of Agriculture Underwriting and Marketing, offers additional insights regarding the initiative.

“We planned to begin with 20,000 farmers across four states and expand into additional Nigerian states and the Sahel region. Although many farmers express interest in insurance, affordability remains a significant challenge,” he reveals.

“In the initial phase, we will subsidise 70 percent of the insurance premium; the subsidy will be available for the first two years to facilitate farmers’ adaptation to the insurance model, and subsequently, we will gradually reduce the subsidy each year. “

This strategy, he adds, is designed to enable a smooth transition to self-sufficiency while maintaining affordability through partnerships and financial mechanisms.

Nurturing resilience for farmers, rural communities

For Mr. Tunde Hassan-Odukale, MD/CEO of Leadway, his company is proud to be at the forefront of this transformation, adding that they are redefining insurance product development in Nigeria by leveraging technology and big data to create solutions that directly address the needs of its clients.

“By providing farmers with a reliable safety net through this product, we are not only mitigating risks but also fostering economic stability in the agricultural sector,” he asserts.

“Index-Based Livestock Insurance is not only a testament to our commitment to innovation but also a testament to our dedication to supporting the growth of Agriculture in Nigeria.”

He firmly believes that the innovative approach will drive progress and prosperity for Nigerian farmers.

Head of Agriculture Insurance at Leadway, Mr Fatona Ayoola, in excitement, notes the introduction of IBLl as a game-changer for Nigerian farmers involved in the livestock production value chain.

For long, our farmers have been exposed to the unpredictability of our weather conditions, attributable to climate change and other unforeseen incidents that can devastate their livestock. thereby affecting their livelihoods,” he says.

“This innovative product was designed to address the challenges of inadequate pasture/forage for the animals and provide investment and financial security to our livestock farmers, herders, and pastoralists.”

Minister of Livestock Development, Alhaji Idi Mukhtar Maiha, calls livestock a cornerstone of Nigeria’s food security and a driving force behind rural prosperity.

He expresses their commitment to confronting drought and conflict head-on, harnessing data-driven strategies and forging powerful alliances between the public and private sectors.

IBLI Potential Based on Recent Studies

Since 2010, index-based livestock insurance (IBLI) has emerged in Kenya as a groundbreaking way to shield livestock keepers from the harsh realities of climate-related risks.

A recent study on the impact of index insurance in northern Kenya reveals that adopting IBLI not only boosted household incomes but also helped pastoralists avoid the worst financial setbacks.

The study by the Agricultural and Applied Economics Association, published in 2025 by the International Livestock Research Institute (ILRI), concludes that policies and investments supporting the expansion of index insurance are effective for climate risk management and welfare improvement in Sub-Saharan Africa by increasing income and reducing exposure to downside risk.

Also, research work titled ‘Climate risk adaptation through livestock insurance: Evidence from a pilot programme in Nigeria’ examined the option of adopting index-based livestock insurance (IBLI) to mitigate the adverse effects of climate change. It evaluated how much IBLI adopters are willing to pay.

The findings indicate that farmers are willing to pay a 1.3% premium for IBLI, a rate lower than the 2% to 5% premium typically charged for traditional agricultural insurance in Nigeria.

“Index-based insurance is a promising strategy for managing agricultural risks and reducing the impacts of natural disasters and climate hazards on farmers,” the researchers note.

“This insurance helps limit losses from droughts, floods, rainfall fluctuations, temperature fluctuations, dry spells, and heat waves.”

Enhancing Solution Adoption

Dalili Advisors, a key player in IBLI development, underscores the imperative of inclusive financing for economic development on the African continent.

The innovative insurance specialist observes that while livestock is crucial to Africa’s economy, insurance penetration remains just 1%, adding that with 80% of African livelihoods vulnerable to climate change, implementing effective solutions is increasingly urgent.

“Thus, we are challenged with the task of engaging this market base, which has historically been difficult to insure due to the small-scale nature of their businesses and the scepticism surrounding insurance solutions,” says Dalili.

The climate risk insurance specialist asserts that Index-Based Livestock Insurance and Innovative Animal Encroachment demonstrate the strong potential for scalable, trusted climate-risk tools on the continent.

“Index insurance provides a powerful shield against climate risks. Unlike traditional models, it relies on objective data, like rainfall measurements, to trigger payouts, bypassing lengthy claims processes and ensuring timely support when communities need it most,” the climate risk advisory firm shares.

“But that’s not all. We believe true resilience comes from combining this financial protection with other tools. We work with communities to build a holistic approach that integrates insurance with early warning systems, risk reduction strategies, and financial literacy programs.”

The initiators maintain that this multi-pronged approach empowers communities such as Isa’s to not only survive but also thrive amid changing climatic conditions.